October 19, 2022

Thank you for joining Cavan Merski and me for our recent webinar about EV charging trends. We’re following up with answers to some great participant questions.

Reminder: you can download the slides we presented and watch a recording of the webinar on our website.

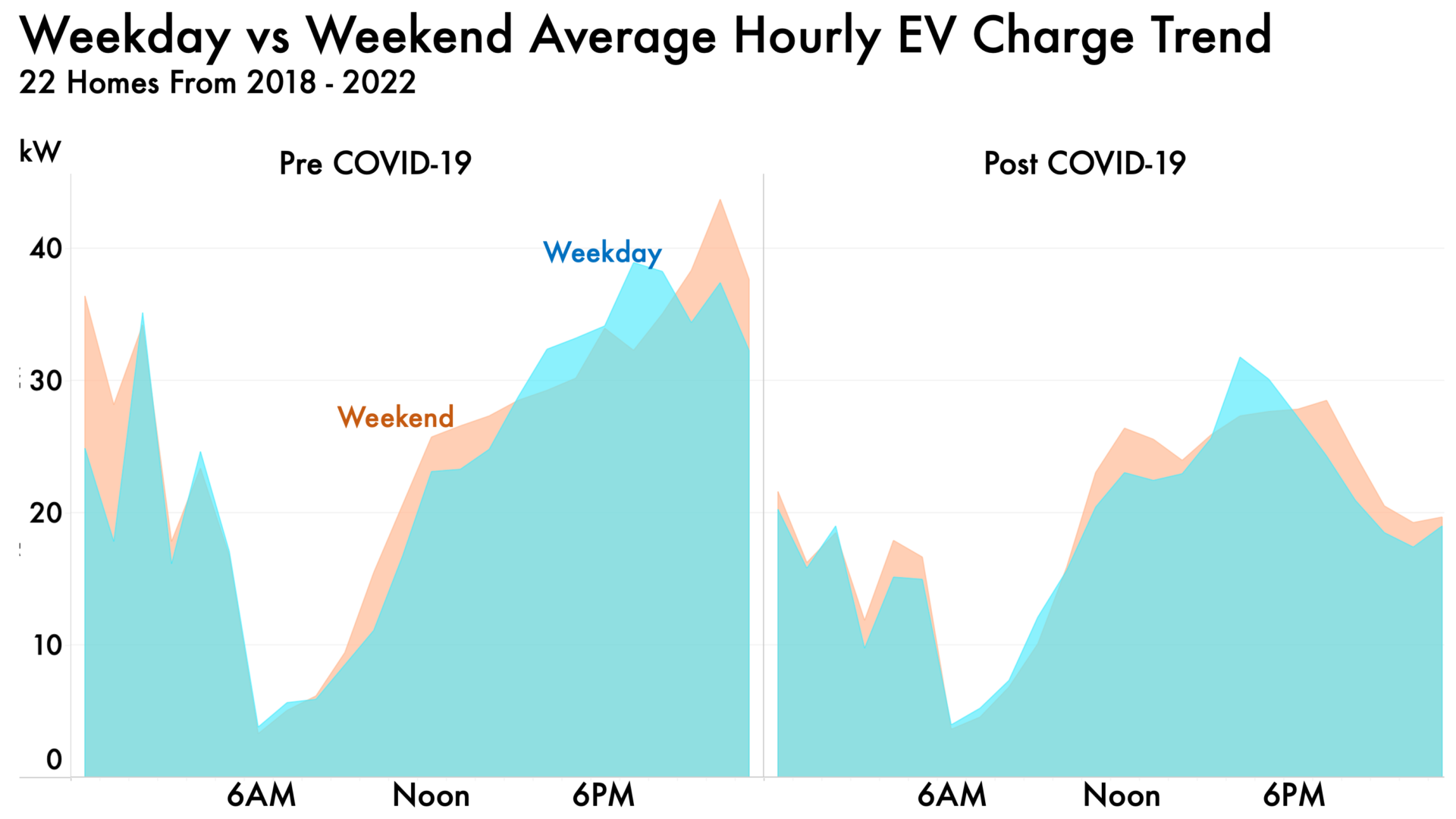

Does the EV home charging distribution across the day vary by weekday/weekend? If so, how significantly? To what extent do you think that the results around demand flexibility will apply when EVs are more widely adopted?

Our data show a difference in EV charging on weekdays and weekends. Weekend charging tends to be slightly higher in the daytime and overnight hours, but lower in the early morning. There’s also a noticeable crest in weekday charging from 4-8 pm, presumably from people charging after they return home from work.

Interestingly, the weekday/weekend difference was larger before the COVID-19 pandemic. Post-commute charging from 4 pm through midnight was much higher, whereas this spike has almost disappeared since the pandemic. The Mueller neighborhood, where a large portion of our EV participants lives, has a higher-than average number of residents who work from home. This, of course, became the norm during the pandemic.

Many newer electric vehicles can charge to different levels based on the user’s next trip (only charging to 100% if a major road trip is imminent, for example). Can Pecan Street integrate this type of EV data? Are the software packages being developed to manage all these complex decision trees coming along? Will we eventually be able to purchase a smart software overlord that can manage all of this and go to the users for decision-making only when judgment calls are required?

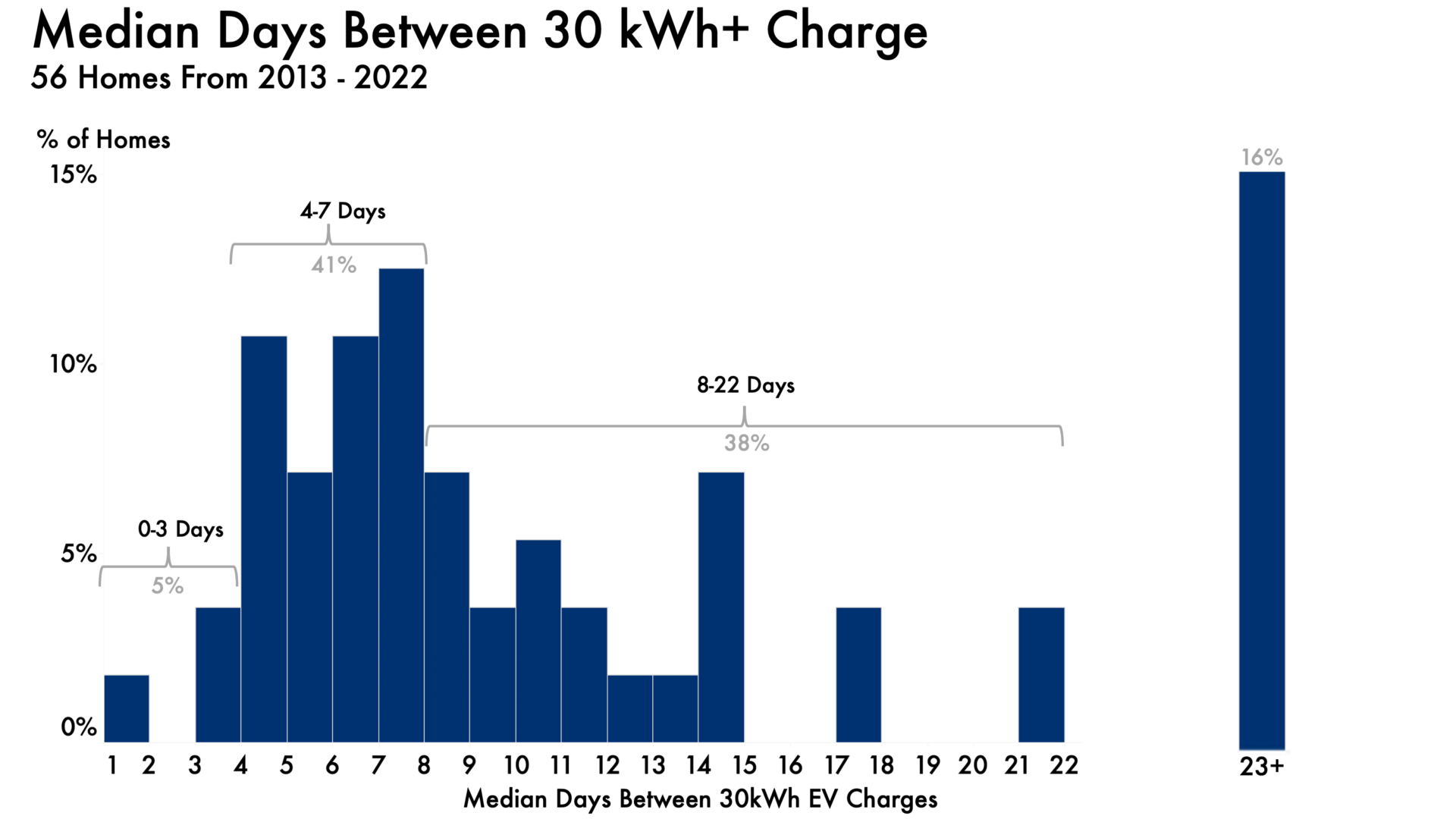

First, we certainly hope it’s not an overlord. But we DO see a need and opportunity for a kind of “energy operating system” that will integrate all these new devices and optimize when they’re used and how they are managed. In addition to extending the life of a battery, charging below full capacity is another way EVs can provide demand response. The potential of this capability can be shown by looking at the frequency of high kWh EV charge events in our dataset.

The graph below shows that large charge events (higher than 30kWh) are relatively infrequent. More than half the vehicles in the sample below had a median of between 7-30 days between these large charge events. Another 41% had a median time between large charge events between 3-7 days. This suggests that the majority of EV owners could flex their charging longer than 24 hours depending on grid and market conditions.

Are you aware of any research on customer willingness to discharge EVs during events to help provide support? Are there concerns about vehicle availability (due to state of charge) after grid events?

The literature on this question is rather limited. In our research, we have seen customers come through with demand response in emergency situations in several instances to varying degrees. Obviously, incentives will play a significant role.

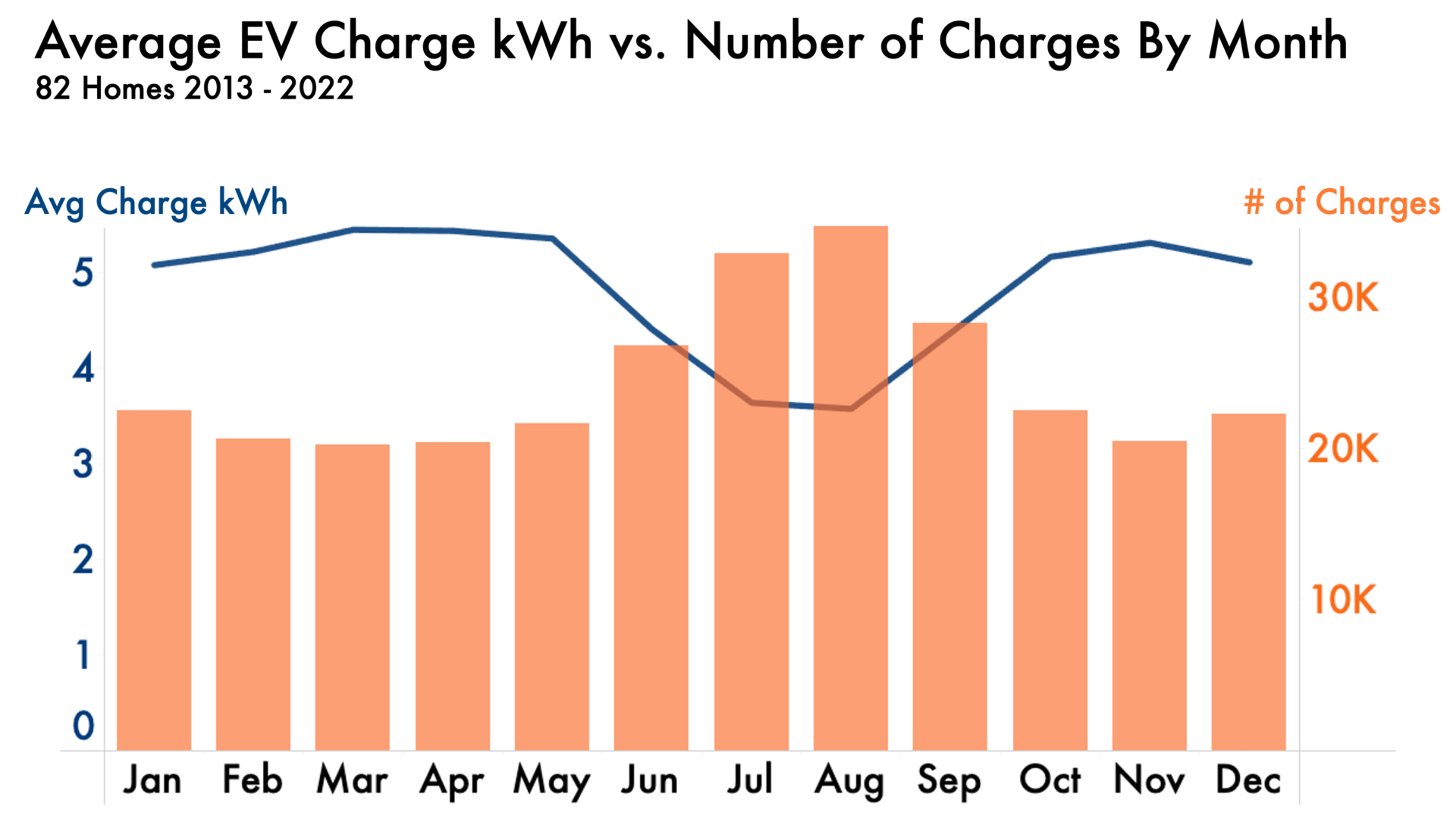

EV-based grid support is such a big opportunity because the batteries are large and, based on our research, people generally charge frequently and in small amounts. Our data also shows seasonality in the way our participants charge. In the summer, participants charge more often. This means that in the current peak season (Texas is a summer peak region…this may shift as more of the economy continues to electrify), EVs will be more available and require less power when they charge.

How effective are smart panels in reducing the need for home infrastructure upgrades to accommodate EV charging? Are upgrades typically needed for Level 2 chargers?

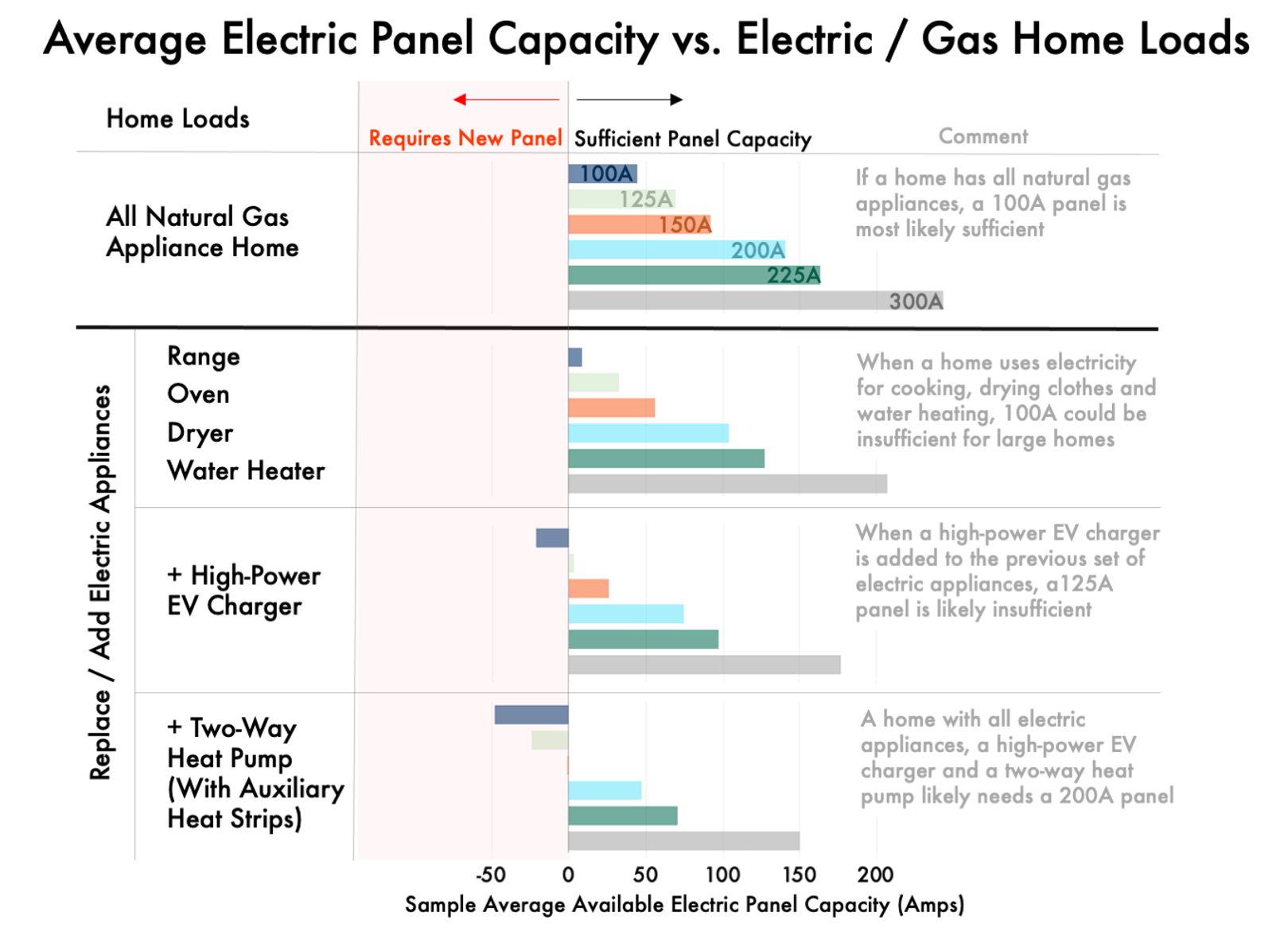

Smart panels generally will be 200A and above, which would be enough to serve most homes, even if the home is all-electric. For larger homes, a 200A smart panel may be able to deliver the performance of an even larger conventional panel because of its ability to control loads and ensure they aren’t running simultaneously (for example, it could turn off the EV charger when the induction stove is used).

The figure below, from our recent whitepaper on electric panel sizing, shows a typical scenario of when a home may require an upgrade. The size of the existing electrical panel and the other electric loads in the home largely determine whether a home will need a panel upgrade if a Level 2 charger is added.

As you increase charge rate (higher kW) over shorter periods, what observations do you have regarding the need for either (1) transformer upgrades or (2) main panel upgrades?

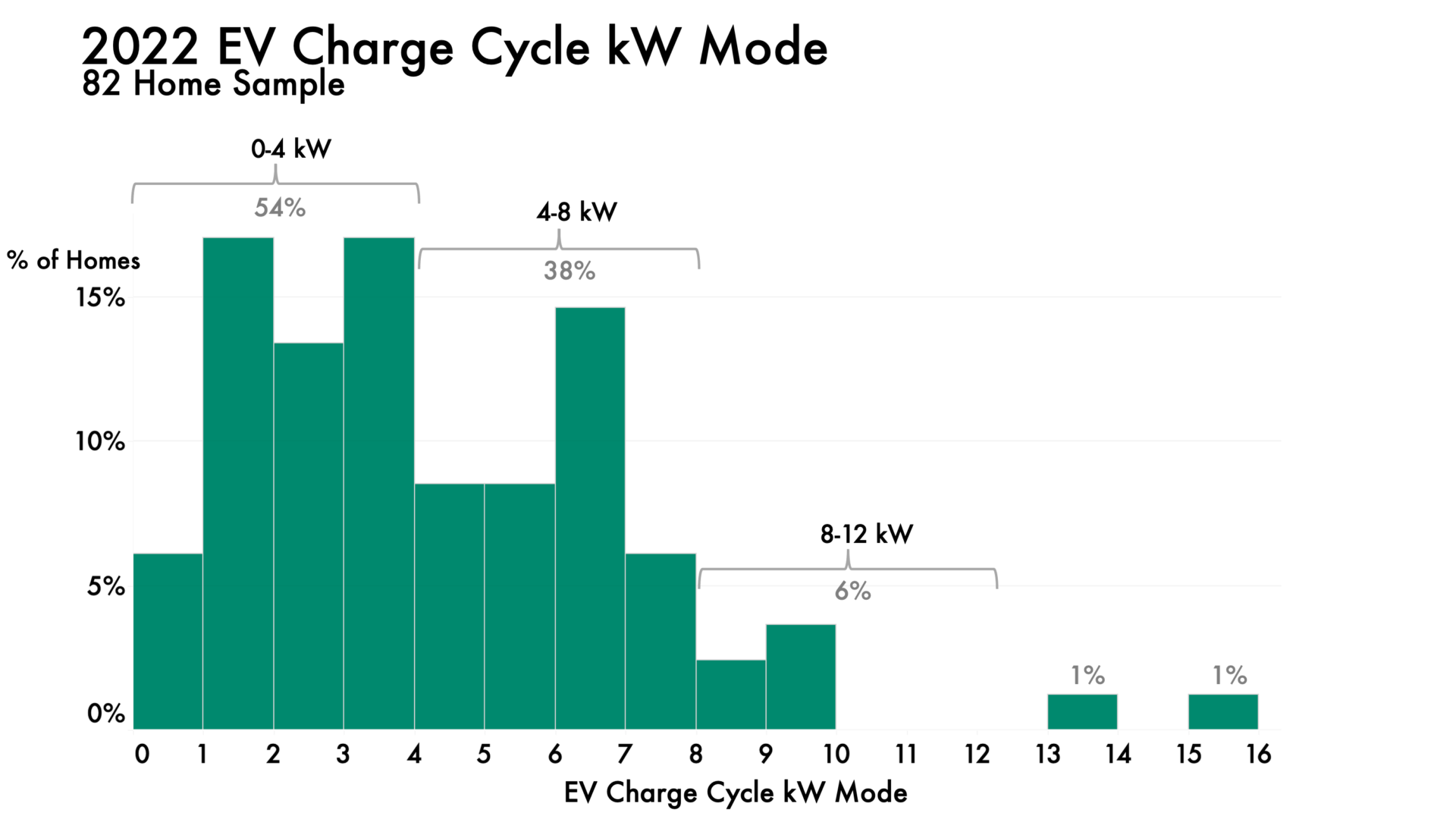

The size of the circuit serving the Level 2 charger and the ability of the EV battery to accept high charge rates will play a large role in determining whether a panel upgrade is necessary. The figure below shows the distribution of charge levels in our network in 2022. Right now, only 8% of EVs in our network charge above 8kW. But this distribution is shifting higher. As new models increase charging rates, this distribution can increase quickly.

Is there data on when they need to use the vehicle to know the opportunity to shift charging based on market conditions?

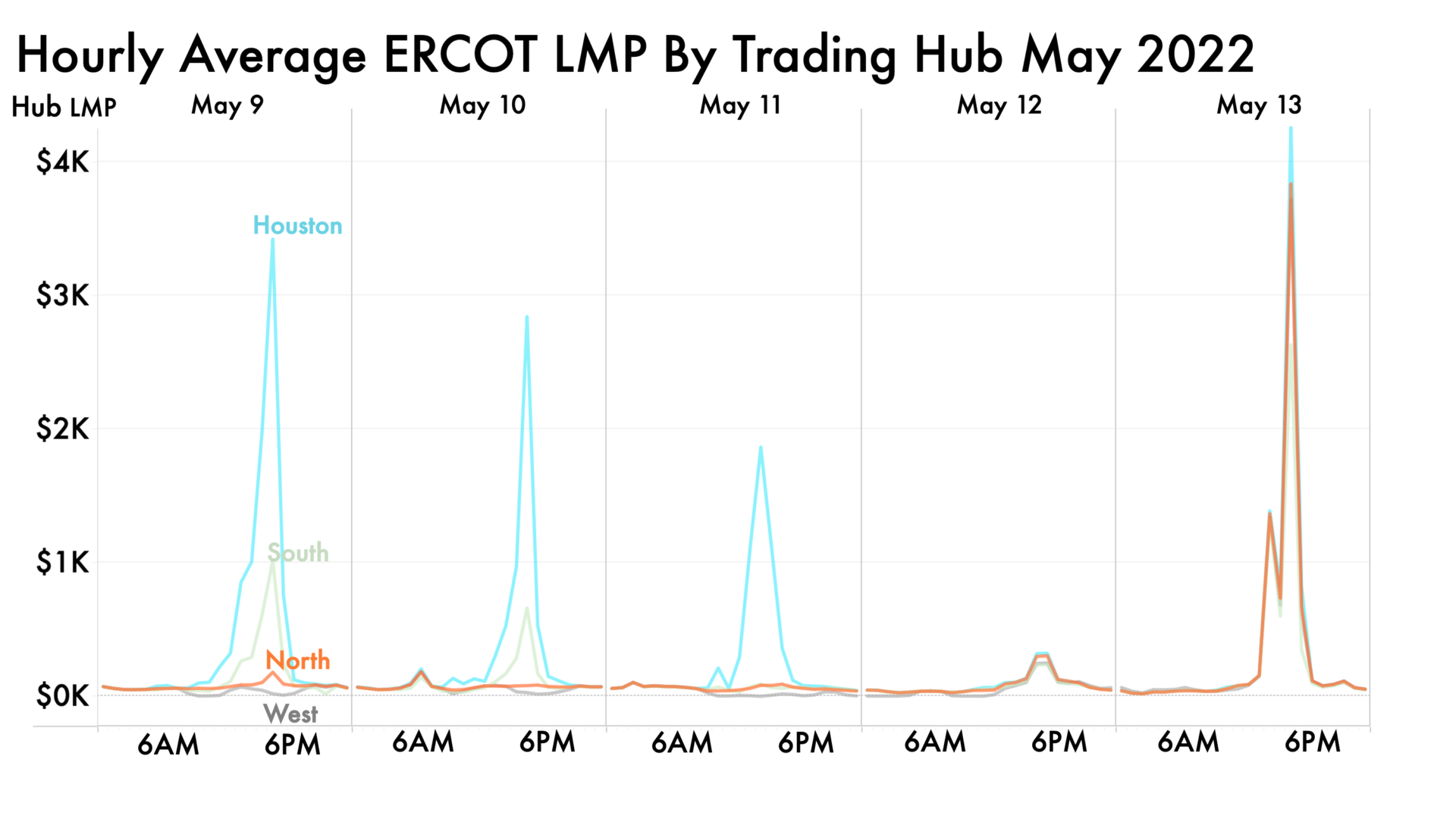

Grid and market conditions depend on many factors like weather, transmission capacity and generation capacity. In ERCOT, a useful proxy for grid demand is the real-time locational marginal price (LMP) of electricity at a given time. When the price is high, there is a strong incentive for market participants to provide electricity to a region.

In the figure below, four main hub prices for ERCOT (North, South, West and Houston) are shown in hourly increments for a week in May when a coal plant near Houston had outages, and several other large generators were offline due to maintenance. Prices in the Houston region were extremely high early in the week, while other regions were much lower. Thus, a service that could aggregate many EVs in Houston would have a strong incentive to provide demand response or V2G services while the other regions may not. This is typically a function of the transmission grid not being able to connect generation with demand. When all regions show high prices, as they did on May 13, it is typically a sign of statewide generation approaching its maximum output.

Are you all aware of any REPs in Texas who are reaching out to EV-owning customers with charging management offers that seek to use the enormous flexibility of EV charging?

Many utilities are piloting programs and starting outreach to customers, but we aren’t aware of any established programs in Texas. This SEPA report has a list of pilots and other managed programs across the country, and here’s an example of an ongoing program from National Grid.